Establishing a foreign-invested company in France

France, as one of the largest economies in Europe, offers an attractive environment for foreign investors looking to establish a business. With its strategic location, access to the EU single market, and well-developed infrastructure, France provides numerous opportunities for enterprise across various sectors.

Establishing a foreign-invested company in France requires knowledge of the French legal system and its financial and administrative framework. Investors must navigate different types of enterprise structures, compliance requirements, and tax regulations to ensure successful business operations. Additionally, choosing the right location, determining the appropriate capital structure, and appointing a legal representative are crucial steps in the process.

This article provides a comprehensive guide for foreign investors seeking to set up a company in France.

1. Investors perform Direct Investments in France

In France, there are two primary forms of investment: direct and indirect. Direct investment involves investors contributing capital and directly holding the rights to manage, control, and utilize their capital in business operations. This typically entails establishing a foreign-owned enterprise in France. Depending on the business sector and specific investment needs, the capital structure of foreign-invested companies can vary. Foreign investors may own a partial or full stake in a company established in France.

As a member of the European Union, France offers significant advantages for foreign investors. Establishing a business in France allows companies to access the entire EU market. Moreover, Companies based in France benefit from the EU’s trade agreements, legal protections, and regulatory framework, enhancing the opportunities for growth and expansion across member states.

2. Types of enterprises in France suitable for investors

French law divides enterprise models through 2 different categories: civil company and commercial company.

Civil company

A civil company is a type of enterprise which can only do non-commercial activities. These are considered non-commercial activities: liberal activities (such as a lawyer), agriculture, real estate construction, and management, etc. Among them, the more suitable for foreign investments are:

- Real estate civil company;

- Construction–selling civil company.

Commercial company

As for commercial companies, French legislation provides a large number of enterprise models to adapt to investor’s needs:

- Sole Proprietorship;

- Partnership;

- Single-member limited liability company;

- Limited Liability Company;

- Single-member simplified joint stock company;

- Simplified joint stock company;

- Joint stock company.

Specific

- Branch Office: A foreign company can open a branch office An extension of a foreign company in France, not a separate legal entity.

- Representative Office: Used for non-commercial activities like market research; it does not conduct business operations.

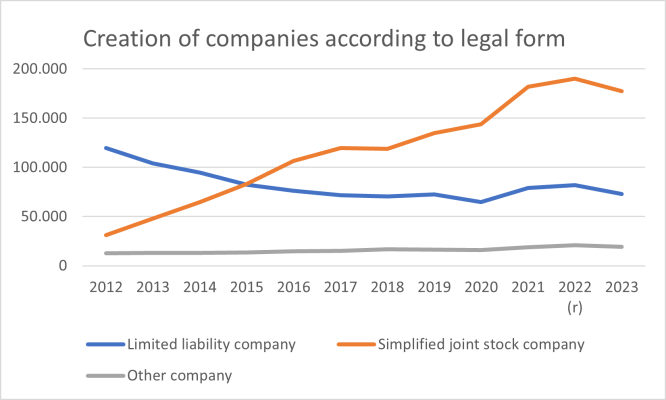

Limited Liability Companies and Simplified Joint Stock Companies are models compatible with foreign investor’s needs. Since its reform in 2009, the Simplified Joint Stock Company has become increasingly popular due to its flexible structure, which can be tailored to investor’s expectations. It also offers limited liability protection for shareholders, providing significant freedom in governance and operations, making it particularly appealing to foreign entrepreneurs seeking adaptability and risk protection.

3. Choosing the location for the operation headquarters of enterprises, and the location of the investment project

To establish a company in France, investors are required to have a registered headquarters within the country, as this is a mandatory legal requirement. France offers a wide range of options for selecting a company headquarters, providing flexibility to investors:

- Option 1: Home Address

A business can be domiciled at the owner’s residence, commonly used by micro-enterprises. This cost-free option requires no dedicated commercial space but compromises confidentiality, as the address appears on official documents. The lease or property rules must allow professional use, and landlords must be notified. Temporary domiciliation (up to 5 years) requires legal declaration.

- Option 2: Rented Commercial Space

Leasing a commercial property separates business and personal life but incurs higher costs. While rental expenses impact cash flow, savings on local business taxes (CFE) may offset costs, depending on the location. A formal lease agreement must comply with French commercial lease laws.

- Option 3: Coworking Space or Business Incubator

Coworking spaces and business incubators offer domiciliation services and additional professional amenities, ideal for startups or freelancers. These cost-effective options foster networking but may not suit all businesses, particularly those needing a formal image.

- Option 4: Domiciliation Company

Domiciliation companies provide business addresses and services like mail forwarding and virtual offices. This option offers flexibility, strategic locations, and potential tax benefits but involves ongoing costs. Contracts must comply with legal requirements and last at least three months.

Note:

-

- Depending on the location, there might be a local urban plan that a commune enacted and that restricts the number or the sector of activities that can be done in an area. For example, there are some areas that are restricted to agriculture activities only.

- When choosing the location of the operating headquarters or the investment project, the company must comply with the environmental law.

4. Regulations on charter capital

After establishing an enterprise in France, investors will receive a certificate of incorporation (K-bis extract). It corresponds to the Company ID card. This document contains a lot of information, notably the charter capital.

When creating a company, investors can contribute to the charter capital through assets or industry. Assets are defined either as cash or in-kind contributions. However, industry involves making one’s skills available to the company: their work, experience, expertise, reputation, etc. The associates must outline this contribution in the articles of association.

Note: A shareholder cannot receive a salary for his industry contribution.

5. Legal representative of enterprises in France

A legal representative is an individual responsible for managing a company. They represent the company to third parties and make decisions essential to day-to-day operations within the powers expressly granted to them by the company.

French regulations do not require the legal representative of a company to be in France. However, company articles of association may stipulate that the legal representative must reside in France. To act as a legal representative of a French company, an individual must have the right to work in France and receive a salary from the company. Therefore, a foreign individual must comply with French regulations to work in France. To work in France, a foreigner must hold a residence permit or visa that authorizes employment. In this case, the relevant visa/residence permit is the one with the mention “Talent: Legal Representative”.

The requirements for the legal representative mentioned above are not necessary for foreign associates. They can freely have their residency abroad. Indeed, through their status, a shareholder may be eligible to have a Talent residence permit with the mention corresponding to their situation.

Note: France does not distinguish between a foreign shareholder and a domestic shareholder, except in certain regulated sectors such as media, defense, and energy. As a result, a foreigner can hold 100% ownership of a company.

6. Required documents

The establishment of a company requires multiple documents such as:

- The corresponding MO form, completed and signed;

- The articles of association, dated and signed;

- Proof of occupancy of the premises;

- A copy of the deed of appointment of the directors;

- A copy of the identity document and a certificate of family ties for each director;

- The original, dated, and signed declaration of non-conviction from each director;

- The certificate of deposit of funds;

- The original declaration of the company’s beneficial owners;

- Payment of registration fees.

Foreigners who are not from a European Union country may be required to submit additional documents.

Foreigner who reside or wish to reside in France

If the foreigner possess a visa or a residence permit that allows to work in France, no further documents are required.

If a foreigner wishes to establish a company in France, they can apply for one of the following residence permits:

- Residence Permit: Entrepreneur/Liberal Profession

- Valid for a maximum of 1 year

- Must demonstrate a genuine and serious business project for the creation of an economically viable company

- Must ensure that the activity is compatible with public safety, health, and tranquility

- Must show resources equivalent to at least €21,203

- Multi-Year Residence Card: Talent Passport – Company Creator

- Valid for up to 4 years

- Must hold a diploma at least at the master’s level or equivalent, or have a minimum of 5 years of professional experience in a comparable position

- Must provide proof of a genuine and serious business creation project in France, demonstrating economic viability, supported by a certificate recognizing the project

- Must show an investment of at least €30,000 in the company project

- Must demonstrate resources equivalent to at least €21,203

(Sources: entreprendre.service-public.fr)

Foreigner who doesn’t want to reside in France

No additional documents are specifically required.

Note: If the foreigner wants to be the legal representative of newly established company, he must hold a a residence permit or visa that authorizes employment.

A visa and a multi-year residence card with the mention Talent passport: Social agent can be applied under the following condition :

- Must have at least one seniority 3 months in an establishment or a company of the same group as an employee or social agent.

- Must justify your appointment acting as legal representative in an establishment or business in France

- Must justify resources corresponding to €64,864.8

(Sources: entreprendre.service-public.fr)

7. Steps to establish a foreign business in France

Step 1: Open a company bank account and gather all required legal documents for company formation. This includes preparation of documents such as the articles of association, identification, and proof of address.

Step 2: Publish a legal notice announcing the formation of your company. This is mandatory for certain types of companies but may not be required depending on the company structure.

Step 3: Submit the company registration dossier to the French Commercial Court Registry. The registration process generally takes 10 to 15 days.

Note:

- Some business sectors may require additional permits or licenses before operating.

- The company must submit an initial tax declaration by December 31 of the year of establishment. Other requirement might be compulsory, such as corporate insurrance, accounting, etc.

8. Tax applicable in France

8.1 Value Added Tax (VAT)

VAT rates applied to foreign enterprises are the same as domestic enterprises. VAT rates are set at 20% (standard), 10%, 5.5%, or 2.1%, depending on the product or service.

8.2 Personal income tax

Employers must contribute to social security, healthcare, and unemployment insurance for their employees.

8.3 Corporate income tax

As of 2024, the standard corporate tax rate in France is 25%, with reduced rates available for small businesses or specific sectors. Indeed, companies with annual revenue under 10 million euros (excluding VAT) and with at least 75% of their capital owned by individuals or qualifying companies, a tax reduction is available. This reduction applies to the first 42,000€ of taxable profit, with a reduced rate of 15%.

8.4 Import and export tax

If a foreign enterprise is involved in the import or export of goods to and from France, the enterprise will be subject to import and export duties. France, as a member of the European Union (EU), applies the EU Common Customs Tariff (CCT), which sets the tax rates for goods imported from non-EU countries.

The import tax rate is determined by the type of goods and their origin and is calculated by multiplying the customs value of the goods by the applicable tax rate. There are three categories of import tax rates:

- Standard Tariff: Applied to goods from countries without preferential trade agreements with the EU.

- Preferential Tariff: Applied to goods from countries with which the EU has trade agreements.

- Special Preferential Tariff: Applied under specific trade arrangements, such as those for least-developed countries under the Generalized Scheme of Preferences (GSP).

Export duties are generally rare in France, but they may apply in exceptional cases, such as to protect certain resources.

Time of writing: 16/03/2025

The article contains general information which is of reference value, in case you want to receive legal opinions on issues you need clarification on, please get in touch with our Lawyer at info@cdlaf.vn

Why choose CDLAF’s service?

- We provide effective and comprehensive legal solutions that help you save money and maintain compliance in your business;

- We continue to monitor your legal matters even after the service is completed and update you when there are any changes in the Vietnamese legal system;

- Our system of forms and processes related to labor and personnel is continuously built and updated and will be provided as soon as the customer requests it;

- As a Vietnamese law firm, we have a thorough understanding of Vietnam’s legal regulations, and grasp the psychology of employees, employers, and working methods at competent authorities;

- CDLAF’s team of lawyers has many years of experience in the field of labor and enterprises, as well as human resources and financial advisory.

- Strict information security procedures throughout the service performance and even after the service is completed.

You can refer for more information: